Table of Content

Many reverse mortgage debtors use a reverse mortgage line of credit as a kind of long-term care health insurance coverage. Any portion of the road that you just don’t contact will proceed to extend, providing you with a growing, go-to source of funds that will help you pay for medical emergencies or your long-term care needs. On a normal mortgage, you construct fairness over time as you pay down the mortgage steadiness.

FHA insurance, which the borrower has been paying for the explanation that loan’s inception, covers the remaining loan steadiness. In this case, the borrowers or heirs could merely hand over the keys to the lender and stroll away, a course of generally identified as a “deed-in-lieu” transaction. Lump-Sum Plan-This plan can be selected as a fixed-rate loan or an adjustable-rate mortgage. Both choices offer a first-year maximum draw of 60% of the principal limit, with an extra 10% of the restrict made available if most obligations exceed the 60% limit. Shopping individual lenders for this info could be very troublesome as a outcome of it is not on their websites, direct contact is required, and every will try and signal you up as a buyer.

Is Now A Great Time To Pursue A Reverse Mortgage?

We recommend you seek the advice of along with your tax advisor to provide guidance in your explicit scenario. With a reverse mortgage, you should meet primary income and credit pointers however you don't make monthly principal and curiosity funds. Keep in thoughts you must proceed to pay all property related charges, taxes and homeowner’s insurance and maintain the property in good situation. It’s also essential to notice that in distinction to a standard residence mortgage or refinance, which requires a certain credit score, a reverse mortgage has no such requirement. Reverse mortgages usually carry larger fees and could be pricey because of origination charges, servicing charges, and third-party closing costs corresponding to an appraisal, title search, and recording prices. Borrowers ought to maintain a sound financial plan and prepare for these fees.

The maximum price is 10% above the initial rate on HECMs that adjust monthly, and 5% above the preliminary price on HECMs that modify annually. However, when the NBS reaches 62, she may refinance the HECM in her own name, since presumably she would have inherited the home. The extra fairness the borrower had within the home when he died, the larger the quantities that would become available to the NBS turned HECM borrower on refinancing.

Is There Multiple Type Of Reverse Mortgage?

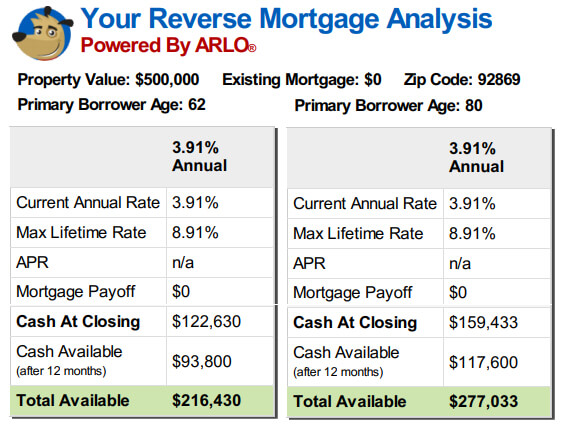

During 2021, the maximum property value on which HECM loan quantities might be primarily based was $822,375. Downey Reverse MortgageThe amount of money that a lender will loan relies upon upon how old you're at the time of closing, how a lot your house is value, the whole amount of liens, and rates of interest. The payoff of your present mortgage and obligatory obligations together with the cost choice chosen will have an result on the sum of money you'll receive.

Google Reverse Annuity Mortgage for permitted lenders in your space. Once approved for a reverse mortgage, there are some upfront fees that must be paid to the lending institution. Sometimes called a RAM, a reverse annuity mortgage is a house mortgage that utilizes your house equity into payments to you. It is completely different from a standard mortgage in that you just don’t should make funds on this loan as long as you’re nonetheless dwelling within the residence. When you progress out of your house and/or sell the home, the mortgage comes due. For instance, let’s say you owe $100,000 on an existing mortgage.

As reverse mortgages turn into more popular, brokers typically subject questions from retirees nervous about what measures are in place to guard them in a period in their lives when circumstances can change all of a sudden. Contact the company servicing your reverse mortgage to find out your choices. If you can’t repay the reverse mortgage stability, you might be eligible for a Short Sale or Deed-in-Lieu of Foreclosure.

To that end, you want to know that many advertisers pay us a payment if you buy merchandise after clicking hyperlinks or calling phone numbers on our web site. 3, Have a direct need for money for any objective besides shopping for a home. You wish to buy a home, perhaps with minimal asset liquidation.

What Is The Function Of My Reverse Mortgage Company/servicer?

If that payment cannot be met, then foreclosures and liquidation by the financial institution are widespread avenues of recourse. Many borrowers are used to having their insurance coverage and property taxes paid for in escrow as a part of their mortgage fee. When they swap to a reverse mortgage, they are not making a mortgage payment, however are still answerable for paying property taxes and insurances. Because these giant bills come due only a couple of instances a 12 months, you will need to set calendar reminders and plan ahead. Term Plan-You select to receive equal month-to-month funds over a finite interval, corresponding to 10 or 20 years. Although your funds will stop in some unspecified time in the future, it is possible for you to to proceed living in the residence.

You make a change within the current HECM by telling your servicer what you wish to do, and paying $20 for the trouble. To refinance, of course, you should re-enter the market, ideally to acquire a model new kosher HECM. Borrowers with an unused credit line can convert it to a month-to-month fee. You are there, simply click on on Rates and Fees at the high of this web page to see the costs on each mounted and adjustable-rate HECMs reported by 9 lenders every week. It additionally reveals weekly historical figures starting August 2, 2016.

If you might have an current mortgage, you could pay it off and take a further 10 % of the available funds, even when the total quantity used exceeds 60 p.c. Your maximum loan dimension is predicated on your home fairness, your age and interest rates. The Arntzes, who owe $88,000 on a home valued at about $340,000, would be succesful of borrow about $189,000. If you suspect a rip-off, or that somebody concerned in the transaction may be breaking the law, let the counselor, lender, or loan servicer know. Then, file a criticism with the Federal Trade Commission, your state Attorney General’s office, or your state banking regulatory company. Stop and verify with a counselor or someone you belief earlier than you sign anything.

Alternatively, you might select the mix that end result within the largest credit line after some interval. Choosing between 0.5% and 2.5% mortgage insurance coverage premiums. Nothing happens along with your current HECM, however you would possibly find it advantageous to pay off that HECM, refinancing into a model new one based on the upper current value. Note that refinancing will scale back the equity in your home realized by your heirs because of the transaction costs which would possibly be financed into the brand new loan.

Costs over time embody curiosity and ongoing mortgage insurance coverage premiums." Most importantly, these charges and costs tend to be "more expensive than other residence loans." Perhaps the most important mistake is drawing as a lot cash as attainable on the closing table, leaving nothing for future use. To some extent, this error rests on a mistrust of adjustable rate mortgages, carried over from the time they took out a regular mortgage to purchase their home. The senior who insists on taking a fixed-rate mortgage can only draw cash at closing; choices to take a credit line or a monthly cost are available only on adjustable-rate HECMs.

No comments:

Post a Comment